Apple's stock is far cheaper today than it has been over the last decade. The transformation of Apple's valuation looks so remarkable, it made me wonder if other large U.S. companies have undergone a similar transfromation. I found some very interesting companies pop up...

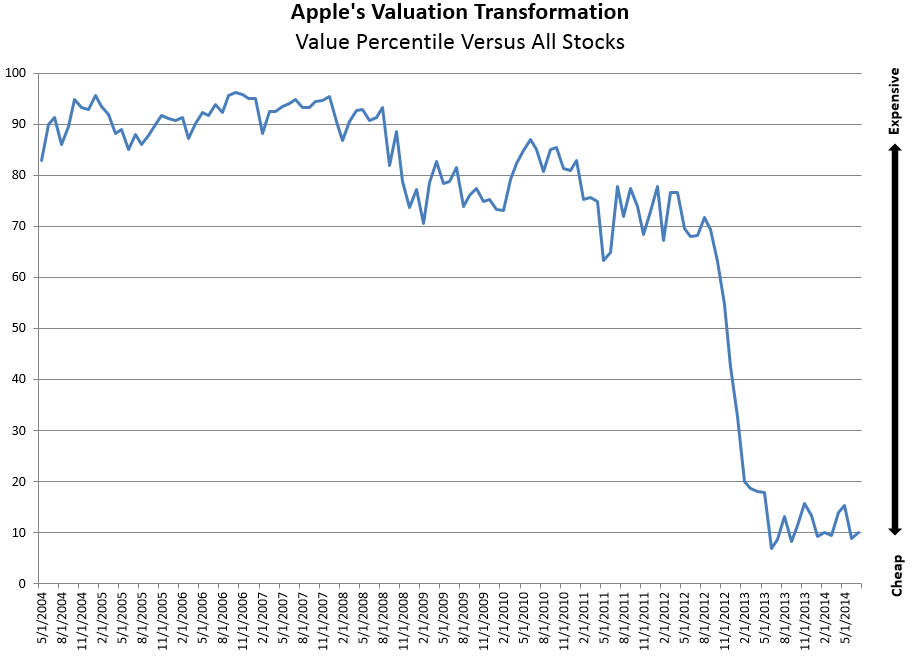

To identify stocks whose relative valuation (compared to all other stocks) has changed the most, I first calculated each large companies average valuation percentile (where 100 is most expensive) over the past 10 years. To measure cheapness, I use measures like price-to-earnings, price-to-sales, EBITDA/EV, free cash flow/EV, and total yield. As a reminder, here is how Apple's valuation has changed.

As it turns out, there are other companies that appear far cheaper today than they have been over the past decade, but Apple still leads the charge. Notice that some of the names, especially Whole Foods, aren't especially cheap today...but they are still much cheaper than in years past.

Here are three other examples: Corning, Coach, and NetApp.

Most valuation measures are used to compare companies across a market or industry at one point in time. But it is also interesting to compare valuations for individual companies against themselves through time.

The reason that value works is that it is a proxy for expectations. Cheap valuations = lower expectations for the future--but these bleak forecasts often turn out to be too grim. This alternative way of looking at value can help investors identify stocks that are both cheap today, but also have had falling expectations over time. To paraphrase Templeton, the key isn't to find stocks for whom the outlook is good, but to find stocks for whom the outlook it is miserable.