Pearls of investing wisdom from unrelated sources.

Care about what other people think and you will always be their prisoner. – Lao Tsu

The market is just a bunch of other people. Collectively, they get too excited or too scared about investments all the time, leaving certain stocks/assets way too expensive or way too cheap. If you let their extreme emotions sway you either way, you’ll lose money.

Some of the best investors are contrarian ones, who think the opposite of what the market thinks. Being a contrarian requires buying stocks about whose futures there is a grim consensus; the market usually hates contrarian/value stocks. It’s hard to be a contrarian because we humans hate being wrong and alone. As Keynes says, “it is better for reputation to fail conventionally than to succeed unconventionally.”

Contrarian and value investing go hand in hand. If you bring up most big value stocks, lots of people will tell you “yea, it’s cheap but it’s cheap for a reason.” Ask ten people what they think about well-known value stock and you’ll usually get 9 negative opinions.

But here is the simple evidence that it pays to follow Lao Tsu’s advice: if you break stocks into deciles (10% buckets) by valuation as I’ve done below, you notice that the less you pay for stocks the more you earn from them. Here are the historical excess returns by valuation decile over the past 50 years, along with some representative example companies from today’s market.

1963-2013, Annualized Excess Returns

Notice the amazing companies (important distinction between company and stock) currently in the most expensive decile: Google, Amazon, Facebook, Starbucks, Tesla. These are all expensive (i.e. the market loves them) because they've been spectacular companies and seem to have bright futures. But you pay an expensive price for a cheery consensus. Some of these stocks may do well, but as a category, the 10% of stocks with the worst valuations have historically underperformed the market by 5.6% per year.[i]

It is easy to talk your way into these stocks despite their price: Tesla might revolutionize how we power everything, and supply their battery technology to other car companies. It’s the only successful car start-up company in 90 years, and its CEO is Steve Jobs' defacto replacement as the world’s leading visionary. During the recent 60 minutes piece on Elon Musk, they said “he may do for cars what Steve Jobs did for phones.” That may be, but if you buy Tesla you are getting a stock that is more expensive than 99% of large companies[ii]—Tesla stock may do for your portfolio what Hydrogen did for the Hindenburg.

Cheap stocks are less exciting. While “new world” tech companies are expensive, “old world” tech like Seagate Technologies and Xerox, are cheap. It’s easy to craft a narrative that value stocks—Seagate and Xerox included—are cheap for a reason, but too often they are too cheap. Again, these specific names may underperform (I include them as points of reference) but as a category, the cheapest 10% has outperformed the market by 4.2% annually since 1963. The U.S. large cap market is supposed to be the hardest part of the market to outperform, but if you are willing to ignore what everyone else thinks, it can be done with ease over the long term. To paraphrase Lao Tsu, if you care about what the market thinks you will always be its prisoner.

There is no fire like lust, no jailer like hate, no snare like infatuation, no torrent like greed. – Buddha

More so than the market itself, our minds (and specifically our emotions) determine our investing success or failure. Fear and greed have devastated more portfolios that any bear market. Fear, in particular, makes us behave like idiots. We are hypersensitive to losses (twice as sensitive to losses as we are to gains) and will make irrational decisions to protect ourselves from pain. Fear causes investors to overdo it on the downside—both during market crashes and in individual stocks (a major reason value investing works). It’s hard to embrace fear (and be a market contrarian), but the least you can do is recognize fear and ignore it. Greed hurts too, because it sedates rationality. Because of our greedy and fearful investment decisions, we earn returns that are several percentage points per year lower than the overall market. Here are some good books about investor behavior: Simple Wealth, Inevitable Wealth, Inside the Investors Brain, The Behavior Gap.

Nature's way is simple and easy, but men prefer the intricate and artificial.—Lao Tsu

Simple strategies often produce the best results, but complex investment processes are seductive. Lots of movement, models, and activity appear sophisticated, but don’t confuse activity with effectiveness. Simple strategies work: indexing (good), fundamental/factor indexing (better), value/quality/momentum based strategies (best).

Take care of what is difficult while it is still easy, and deal with what will become big while it is yet small.—Lao Tsu

For young investors starting out, the best policy is to make good allocation/strategy decisions and then stick with them. Make investing automatic by making 401(k) contributions and/or automatic transfers to brokerage accounts. Rebalance on a set schedule. Making your investments automatic will remove most of the behavioral landmines that create the gap between market returns and investor returns (Carl Richard’s behavior gap). The fewer decisions you have to make as an investor, the better, because every decision is a chance to screw up.

Do not believe what you have heard. Do not believe in tradition because it is handed down many generations. Do not believe in anything that has been spoken of many times. Do not believe because the written statements come from some old sage. Do not believe in conjecture. Do not believe in authority or teachers or elders. But after careful observation and analysis, when it agrees with reason and it will benefit one and all, then accept it and live by it. – Buddha

If you aren’t just buying and index fund, then you need to do your own homework. The investing world is full of experts making predictions, but as David Dreman and Philip Tetlock have made clear in their studies of expert predictions, we stink at predicting the future. At Tetlock says in his book Expert Political Judgment:

These results plunk human forecasters into an unflattering spot along the performance continuum, distressingly closer to the chimp than to the formal statistical models. Moreover, the results cannot be dismissed as aberrations…Surveying these scores across regions, time periods, and outcome variables, we find support for one of the strongest debunking predictions: it is impossible to find any domain in which humans clearly outperformed crude extrapolation algorithms, less still sophisticated statistical ones.

Don’t listen to predictions. Making investment decisions on the basis of expert opinion (for the market or for individual stocks) is a road to ruin.

What has been will be again, what has been done will be done again; There is nothing new under the sun. —Ecclesiastes

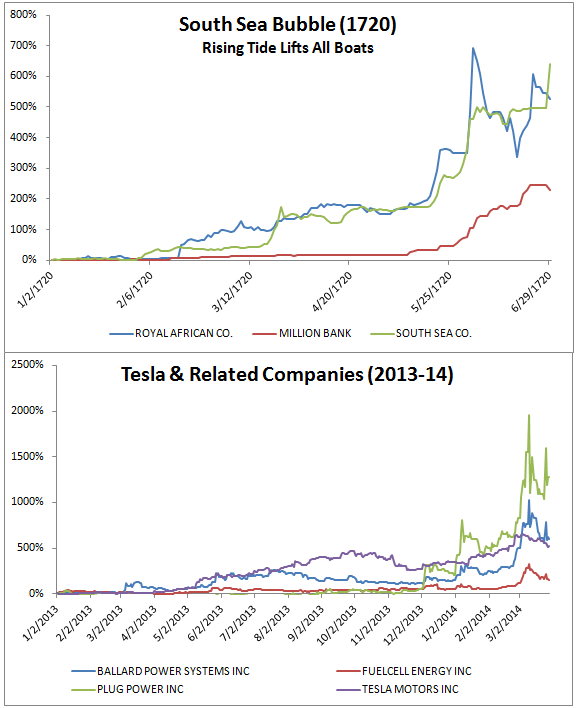

Market behavior never changes. The names, industries, and participants do—but the patterns are always the same. Here is an updated look at a chart I posted earlier comparing the first stock market bubble to a current one.

People keep buying expensive stocks because there is always the chance that one of these outrageously expensive stocks works out. Google and Apple both had P/E’s north of 100, after all, and they’ve been two of the best stocks over the past decade. But for every Apple there are countless other speculative, overpriced messes. In the past 50 years, companies with P/Es>100 have underperformed the markets by 5.1% per year (and that includes the Apples of the world that have outperformed). Might Plug Power grow its way out of this valuation nightmare? Sure, it’s possible, but it’s not probable.

Nature does not hurry, yet everything is accomplished. – Lao Tsu

Don’t just do something, sit there! – Zen joke

The road to wisdom runs through calm inaction, desireless waiting – Lao Tsu

Maybe the best piece of investment advice. As Tolstoy said, the greatest warriors are time and patience. Be in the market for a long time, don’t tinker, let compounding work.

The future, which is already here, like an oak in the acorn – Joseph Campbell

Invest early, sensibly (simple global index funds, rules based strategies with consistent and repeatable processes), and then wait 20-40 years.

[i] It is important to note that the universe/benchmark here is large stocks, but the effect is even more pronounced among small caps (think Plug Power et al).

[ii] Based on measures like price-to-sales, price-to-earnings, ebitda/ev, etc.